Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

Sustainable commodities: Rethinking investment strategies for a changing climate

As climate change and the energy transition reshape global markets, commodities are gaining renewed attention as inflation hedges and portfolio diversifiers. This article introduces a climate integration framework for evaluating commodity investments through both sustainability and financial lenses.

Transition at risk: Checking in on corporate decarbonization progress

Corporate climate transitions face ambition-execution gaps. Success requires integrating decarbonization into business strategy, focusing on emissions, pragmatic Scope 3 approaches, transparency, and credible plans. See how our experts are thinking about this.

Investing in climate solutions across public and private markets

Collaboration between public and private market investors can be powerful. Opportunities where expertise and resources can be shared to accelerate innovation and deployment are optimal. Our experts explore how AI, geopolitics, and global policy are reshaping climate solutions across sectors.

2024 Climate Report

Aligned with TCFD recommendations, this report describes how we manage climate-related risks and opportunities, engage with companies on climate change, and reduce our own carbon footprint.

Human capital management for private companies

We discuss why effective people management is critical for private companies and outline four strategic focus areas that can help companies navigate evolving employee needs, regulatory changes, and investor expectations.

Broadening impact through multi-theme fixed income investments

Multi-theme fixed income impact investments can drive sustainable development by aligning with multiple Sustainable Development Goals, ensuring broad-based impact.

Finding climate investment opportunities amid shifting US policy

We delve into the evolving landscape for climate investments in the US and explain areas of overlap between government policy, corporate commercial interests, and climate focus.

Evaluating human capital management amid AI adoption: A guide for investors

This guide explores the critical role of HCM in maximizing AI's potential benefits, from productivity to innovation. Wellington ESG analyst Caroline Conway also provides targeted engagement questions to ask management teams as they navigate their AI journey.

Integrating end-beneficiary insights into impact investing: Microfinance case study

Louisa Boltz and Oyin Oduya join with Pranav Sridhar from 60 Decibels to examine best practices for bringing end-beneficiary insights into impact investing.

Collaboration in practice: Climate venture capital

Greg Wasserman, Head of Private Climate Investing, highlights the importance of collaborating with Wellington’s later-stage private market investors and public market experts to better understand best practices, valuation, exit opportunities, and more.

Climate venture capital: Innovation versus hype

Greg Wasserman, Head of Private Climate Investing, discusses the balance between innovation and hype in climate venture capital. He explores automation in agriculture and manufacturing as well as the emerging commercial applications of generative AI.

2024 Sustainability Report

We appreciate the opportunity to share our approach to advancing sustainable practices across our investment, client, and infrastructure platforms.

A decade of impact: Verifying our impact investing funds

Our impact investing strategies have been verified by BlueMark, the leading provider of independent impact verification and intelligence for the sustainable and impact investing market.

How stewardship can bring perspective amid uncertainty

Portfolio Managers Yolanda Courtines, Sam Cox, Investment Director Alex Davis and Investment Specialist Fred Owens-Powell examine how a stewardship perspective can help equity investors uncover opportunity amid uncertainty.

Climate venture capital: Deployment, valuations, exits

Greg Wasserman, head of private climate investing, explores today’s normalizing valuations, encouraging IPO and M&A trends, and potentially actionable opportunities in climate venture capital.

Power play: Building the case for infrastructure in 2025

The long-term case for listed infrastructure remains compelling. But could near-term catalysts, such as nuclear and natural gas, also drive performance in the short term?

WellSaid: Partnering with climate founders

Wellington head of private climate Greg Wasserman discusses his team's approach to helping private companies progress along their growth journey

Wiring the future: Emerging tech for the transmission-grid build-out

Learn how our climate technology investment team is researching private market opportunities in high-capacity conductors and other energy grid-tech innovations.

Implementing decarbonisation guidelines: lessons learned in collaboration with clients

For asset owners with net-zero ambitions, balancing decarbonisation goals with investment objectives can be a challenge. Climate Transition Risk Analyst Julie Delongchamp outlines a practical five-step approach to implementing tailored guidelines.

Geopolitics in 2025: Risks, opportunities, and deepening uncertainties

Geopolitical Strategist Thomas Mucha outlines his structural, policy, and geopolitical outlook for the year.

Private market perspectives

Hear from private market experts across our early-stage venture, climate growth, late-stage biomedical, late-stage growth, private credit, and ESG teams.

Climate adaptation may cost trillions. Is your portfolio ready?

With climate adaptation and resilience spending projected to exceed mitigation spending sixfold by 2050, we believe investors should consider allocations to adaptation-aligned opportunities.

Governance best practices in public markets

For private companies approaching the public markets, we highlight the corporate governance best practices that can help pave strong relationships with public market investors.

Measuring impact in venture capital

We highlight why venture capital matters to impact investors and how to authentically measure and manage impact in this asset class.

Impact measurement and management: addressing key challenges

Our IMM practice leader describes common impact investing challenges and suggests ways to overcome them.

Unlocking the full value potential of stewardship

Yolanda Courtines and Alex Davis examine how corporate stewardship can be a source of value and delve into what investors can do practically to maximise its full potential.

Decoding impact expectations: best practices for impact investors and companies

We share three recommendations each for impact investors and companies to help them better understand and manage each other's expectations.

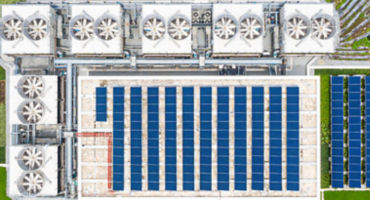

Navigating AI resource demands: Strategies for sustainable data center operations

AI's growing computational demands are raising critical questions about energy efficiency and water-resource management. We delve into strategies for enhancing sustainable data center operations, highlighting the importance of proactive resource stewardship.

Impact measurement and management practices

What constitutes an impact investment? How is impact measured? And, what are the benefits of impact investing? Our Impact Management and Measurement Practice Leader Oyin Oduya discusses our approach.

Assessing the impact of climate resilience

Oyin Oduya and Louisa Boltz discuss the case for impact solutions focused on climate adaptation and share high-level guidelines to help overcome the associated measurement challenge.

Commodities and the energy transition: Symbiosis for the future

The global energy transition is driving demand for commodities. Our experts explain which ones will be needed most.

Office to multifamily conversions: Implications for CMBS investors

Our experts explore the emerging trend in some US cities of converting office space into multi-family units and its implications for bond investors.

Cybersecurity for private companies

We highlight today's rising cybersecurity risks, explore how they impact private companies, discuss key regulatory considerations, and share best practices for companies facing these threats.

Impact investing in emerging markets: Growing opportunities, shifting challenges

Members of our impact bond team discuss their evolving emerging markets opportunity set and the importance of a bottom-up approach to value creation.

Why an impact lens is an important tool in the fixed income investor's arsenal

Campe Goodman, Will Prentis and Oyin Oduya discuss how an impact lens can be an important tool in the fixed income investor's arsenal.

Picking the right building blocks for a climate-aware portfolio

For asset owners integrating climate change into their multi-asset portfolios, members of our Investment Strategy & Solutions Group offer five important insights.

A blueprint for building climate-aware multi-asset portfolios

Members of our Investment Strategy & Solutions Group take a deep dive on the issues asset owners should consider when choosing climate-aware portfolio building blocks, from the evolving opportunity set to the active/passive decision.

Will proposed corporate governance reforms help to narrow the “Korea discount”?

Could South Korea's Corporate Value-up Program help to narrow the so-called “Korea discount” and build on the momentum gathering pace elsewhere across Asia to improve corporate governance and shareholder returns?

Five key ESG topics for private companies in 2024

See where our ESG for Private Investments team is focusing to minimize investment risk and maximize company value in 2024 and beyond.

The growing importance of supply chain transparency

Head of Sustainable Investment Wendy Cromwell explains why supply chains remain a key investment risk and details related research areas for our SI team in 2024.

Sustainable Investment Outlook

Our head of Sustainable Investment shares key areas of focus for 2023, including climate change and biodiversity, modern slavery, data privacy, shareholder rights, and impact investing,

Private investing portfolio company interview with AMP Robotics CEO

Dr. Matanya Horowitz, CEO of AMP Robotics, highlights how the company integrates AI and robotics into the recycling industry and explores the “actionable guidance” Wellington provides on ESG and other strategic issues.

Why climate change matters in private markets

We explore why climate change matters in private markets, highlight the current regulatory landscape, and profile key questions to expect from public market investors.

WellSaid: Partnering with portfolio companies

Co-head of private investing Michael Carmen explores how we partner with portfolio companies to help them along the "last mile from the private market to the public market" including on key ESG issues for private companies to consider.

Is your asset allocation ready for the realities of climate change?

Our Investment Strategy Team shares key findings from the research behind their climate-aware strategic asset allocation (SAA) approach, including challenges and trade-offs that asset owners should understand.

A guide to ESG materiality assessments

We continue our "ESG insights for private companies" series by exploring ESG materiality assessments, including why they are important and how to conduct one for your private company.

Designing a climate-aware strategic asset allocation

Members of our Investment Strategy Team explain how they incorporate climate metrics into their asset allocation optimization process. They also discuss implementation — the choice of specific climate-aware building blocks and strategies to express the desired asset allocation.

European credit: seeking to make the most of the new market regime

Fixed Income Portfolio Manager Derek Hynes and Investment Specialist Jillian Rooney assess why the new market regime is creating potentially compelling opportunities in the European credit market.

The role of ESG in fintech

Global Industry Analyst Matt Ross and Portfolio Manager Matt Lipton explore the role of ESG in fintech in this clip from their WellSaid podcast episode.

Navigating the new global economy in 2023

This executive summary distills the points of view of several of our 2023 Outlook authors. Discover the risks and opportunities they see as we enter a new economic and market regime.

Picture this: Our 2023 economic forecast in five charts

We explain the shifts the market is undergoing, analyze the implications for different asset classes, and identify potential risks and opportunities in a series of visuals.

Perspectives on today’s alternative investment environment

Take a quick tour of the alternative investment environment with investors from across our macro research and hedge fund teams, as they explore the geopolitical landscape, macro volatility, and key trends like climate-change adaptation and digital tokenization.

Focusing on value amid rising global challenges and opportunities

Our Sustainable Investing (SI) Research Team offers a high-level view of 2023 research and engagement priorities.

Advancing stewardship on biodiversity: Engagement examples

Members of our ESG Research Team share their approach to and examples of engagements on the financial risks of biodiversity.

Key drivers for investors in 2023 and beyond: sustainability, disruptive technology, and alternatives

Head of Asia-Pacific Client Group Scott Geary reflects on the overarching themes from the 2022 Milken Asia Summit and the future of investing.

Physical climate risks: Implications for investors

Director of Climate Research Chris Goolgasian and Woodwell Climate Scientist Zach Zobel discuss how investors might use climate science as an input for financial decision-making.

Equity investing with a thematic lens: Three game changers for 2023

Head of Investment Research Mary Pryshlak and Equity Portfolio Manager Tim Manning highlight their strongest convictions across global equity markets heading into 2023.

Wind at their backs: What the IRA means for clean energy industries

Members of our energy and utilities teams break down the range of impacts of the US Inflation Reduction Act on companies in their sectors.

The growing power of impact investing

Impact Measurement and Management Practice Leader Oyin Oduya appears on the WellSaid podcast series to discuss the future of impact investing, her research approach, and how her team thinks about generating market-rate returns alongside positive social and environmental outcomes.

Toward carbon neutrality: Our approach to carbon offsets

Wellington has committed to be carbon neutral in our operations by the end of 2022. Members of our Sustainable Investing and Corporate Sustainability Teams describe our multifaceted approach to achieving that goal.

URL References

Related Insights