Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

Human capital management for private companies

We discuss why effective people management is critical for private companies and outline four strategic focus areas that can help companies navigate evolving employee needs, regulatory changes, and investor expectations.

Wiring the future: Emerging tech for the transmission-grid build-out

Learn how our climate technology investment team is researching private market opportunities in high-capacity conductors and other energy grid-tech innovations.

WellSaid: Partnering with climate founders

Wellington head of private climate Greg Wasserman discusses his team's approach to helping private companies progress along their growth journey

Governance best practices in public markets

For private companies approaching the public markets, we highlight the corporate governance best practices that can help pave strong relationships with public market investors.

Measuring impact in venture capital

We highlight why venture capital matters to impact investors and how to authentically measure and manage impact in this asset class.

Decoding impact expectations: best practices for impact investors and companies

We share three recommendations each for impact investors and companies to help them better understand and manage each other's expectations.

AI governance for private companies

Explore the critical need for AI governance for private companies, addressing evolving risks, regulations, and best practices for responsible gen AI usage.

Cybersecurity for private companies

We highlight today's rising cybersecurity risks, explore how they impact private companies, discuss key regulatory considerations, and share best practices for companies facing these threats.

Hyper-personalization and the AI-driven commerce revolution

A member of our early-stage venture team explores the many ways in which artificial intelligence is likely to transform the consumer experience.

Five key ESG topics for private companies in 2024

See where our ESG for Private Investments team is focusing to minimize investment risk and maximize company value in 2024 and beyond.

Growth efficiency: The new venture capital regime

Frederik Groce, Deal Lead for Wellington Access Ventures, explores how the 'growth-at-any-cost' venture capital regime has shifted to a focus on growth efficiency, highlighting two key metrics for companies to keep top of mind.

Private investing portfolio company interview with AMP Robotics CEO

Dr. Matanya Horowitz, CEO of AMP Robotics, highlights how the company integrates AI and robotics into the recycling industry and explores the “actionable guidance” Wellington provides on ESG and other strategic issues.

Supporting the next generation of entrepreneurs

We highlight how Wellington Access Ventures, our early-stage VC platform, partners with historically underrepresented founders and offers the capital, resources, and networks that these companies have historically lacked.

Private investing portfolio company interview with RayzeBio CEO Ken Song

Dr. Ken Song, President and CEO of RayzeBio, discusses the company’s innovative approach to radiopharmaceuticals and highlights how Wellington’s public and private investment expertise is distinctive in the health care space.

Why climate change matters in private markets

We explore why climate change matters in private markets, highlight the current regulatory landscape, and profile key questions to expect from public market investors.

WellSaid: Partnering with portfolio companies

Co-head of private investing Michael Carmen explores how we partner with portfolio companies to help them along the "last mile from the private market to the public market" including on key ESG issues for private companies to consider.

A guide to ESG materiality assessments

We continue our "ESG insights for private companies" series by exploring ESG materiality assessments, including why they are important and how to conduct one for your private company.

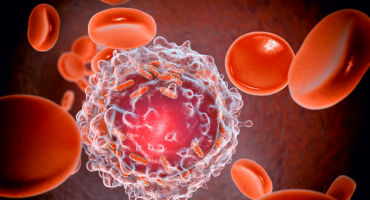

Private biotech market: Innovation, valuations, and capital efficiency

Co-heads of biotech private investments I-hung Shih and Nilesh Kumar join host Thomas Mucha to explore today's private biotech market, highlighting the state of deal flow, valuations, and innovation.

The role of ESG in fintech

Global Industry Analyst Matt Ross and Portfolio Manager Matt Lipton explore the role of ESG in fintech in this clip from their WellSaid podcast episode.

URL References

Related Insights