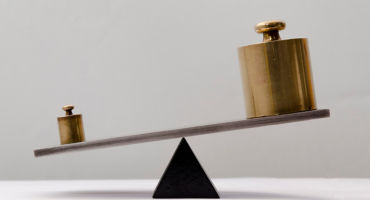

As this new market regime dawns, it’s possible that so, too, may a new environment for equities.

Time to shelve the old investment playbook?

It seems unlikely that what has served investors well in the past will continue to do so in today’s (and tomorrow’s) new environment. And yet, even as the market regime has begun to shift over the past year, market participants seem anchored to the playbook that they’ve been using for the past 10-plus years.

Changing an investment mindset is a big psychological undertaking. It’s human nature to fall victim to recency and availability bias. At this point in time, most investors, strategists, and policymakers have spent their entire careers in a moderate-growth, low-inflation, low interest-rate regime. This “goldilocks” environment has persisted for about three-quarters of the period since the mid-1990s. The long-standing persistence of the old economic world order only makes it that much harder for market participants to alter their mindset along with the ongoing regime change.

At the same time, while today’s market environment represents a departure from what’s dominated for the past few decades, it’s important to remember that these emerging trends are not entirely new. Triggered by the pandemic and the resulting policies that accelerated long-building structural trends, such as aging demographics, deglobalization, and decarbonization, the world is now returning to the pre-1995 norm, when economies frequently oscillated between cycles — different stages of growth/recession and inflation/deflation.

Equity investment implications of a regime shift

Returning to an environment of higher nominal rates, greater volatility, and more frequently oscillating and desynchronized economic cycles could impact the equity landscape in several ways:

Increasing country and sector dispersion

Among global central banks, monetary policy dispersion in response to inflation has already made itself visible. Going forward, countries will enter and exit cycle stages at different times, and, as a result, for the rest of this year and beyond, risk mitigation and global diversification among equities could be more critical than they’ve been in the post global financial crisis period.

More volatility in fundamentals and asset prices

Normalized valuations could go lower, particularly among “long-duration” equities. Going forward, with higher interest rates and increased volatility in fundamentals and asset prices, we expect to see greater demand for relatively stable assets, and the return of more frequent, less synchronized market cycles across regions. Higher volatility and greater cycle dispersion also open the door to opportunistic, thematic, and macro investing — areas of the market that struggled in the prior environment.

Market breadth to expand beyond top tech stocks

For years, a small number of technology companies have driven an outsized proportion of outperformance in the S&P 500 Index, a proxy for the broader US equity market. Today, the information technology sector easily represents the highest percentage of the index (Figure 2).

Equity Market Outlook

In our Equity Market Outlook, we offer a range of fundamental, factor, and sector insights.

By

Andrew Heiskell

Nicolas Wylenzek