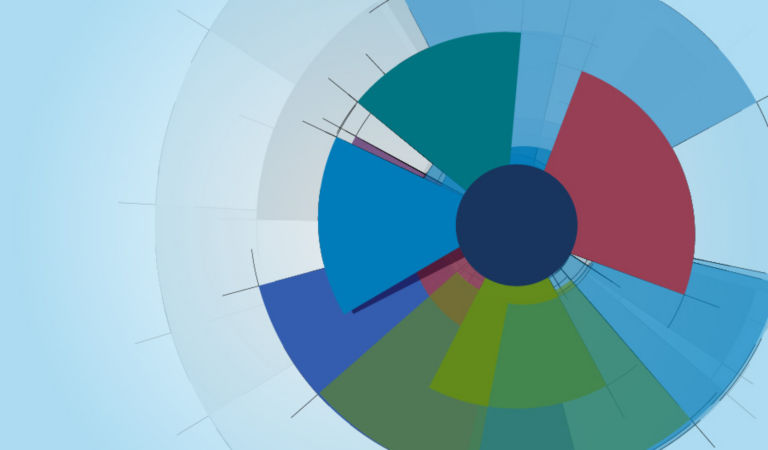

Equities

Global equities (+4.1%) rose in November to register a substantial year-to-date return of 22.7%. Donald Trump’s presidential reelection and the Republican Party’s sweep of both chambers of Congress led the US to significantly outperform other regions amid expectations for deregulation, additional tax cuts, and a more accommodative US business environment. The breadth of change anticipated from the new US administration reverberated across the globe, with far-reaching implications for foreign policy, trade dynamics, inflation, and economic growth. Elon Musk’s appointment to the newly formed US Department of Government Efficiency (DOGE) extended a strong risk appetite in markets. Prospects for a soft landing appeared to remain intact, and central banks in the US, UK, New Zealand, Mexico, and Sweden continued to lower interest rates. Inflation neared central bank targets in many regions. However, in November, a key measure of US inflation rose for the first time since March, and UK inflation surged to its highest level in six months, highlighting the ongoing sensitivity of prices to economic changes. Eurozone business activity sank to a 10-month low in November, while Germany’s coalition government collapsed, and the country’s manufacturing sector remained mired in a deep downturn. In France, Prime Minister Michel Barnier’s cabinet confronted a possible vote of no confidence. A stronger US dollar pressured emerging markets, and Chinese equities declined amid limited government aid and low consumer demand. Geopolitical risks remained heightened, and the Russia/Ukraine war raged on, while the US and France brokered a ceasefire agreement between Israel and Hezbollah.

US

US equities (+5.9%) surged in November, registering a 28.1% gain year to date. Small-cap stocks led a broad equity rally after US elections shifted the balance of political power to the Republican Party. Republicans maintained a slim majority in the House of Representatives and secured control of the Senate, cementing a path for President-elect Donald Trump to enact major policy initiatives, including tax and spending cuts, deregulation, and nationalist trade policies. Risk sentiment was further fueled by favorable economic data, underscored by a resilient labor market, solid consumer spending, and improved consumer and business sentiment. The Fed lowered interest rates by 25 basis points (bps), although Fed Chair Jerome Powell signaled more concern about the inflation outlook, as stalled disinflation momentum and sturdy economic growth increased the potential for a pause in rate cuts in the months ahead. In October, the core Personal Consumption Expenditures (PCE) Price Index ticked up to 2.8% annually after stabilizing at 2.7% in the prior three months. Third-quarter earnings were better than expected; according to FactSet, of the 95% of companies in the S&P 500 Index that had reported earnings, the blended year-over-year earnings growth rate for the index was 5.8%, above the 4.2% estimate on September 30.

Economic data released during the month indicated that the economy remained very healthy. The labor market stayed firm overall despite some modest softening in October’s data. Nonfarm payroll growth of 12,000 was significantly below consensus but was distorted by two severe hurricanes, while payroll growth in August and September was revised lower by 112,000. The unemployment rate ticked slightly higher to 4.14%, initial jobless claims were the lowest since April, continuing claims rose to a three-year high, and average hourly earnings growth showed signs of stabilizing near 4% year over year. Consumers maintained a solid pace of spending ahead of the holidays; retail sales rose 0.4% following a sizable 0.8% gain in September, and personal spending increased 0.4% in October after an upwardly revised gain of 0.6% a month earlier. In November, the Conference Board’s Consumer Confidence Index ticked up to its highest level (111.7) in more than a year, driven by a more positive assessment of the present situation, particularly for the labor market. Homebuilders were more optimistic about expectations for fewer regulatory hurdles under the Trump administration, although the housing market remained strained by low inventory, highly elevated prices, and a renewed rise in mortgage rates.

In November, the manufacturing sector contracted at a slower pace as the Institute of Supply Management (ISM) Manufacturing Index rose to a five-month high of 48.4. The result was above market expectations and reflected improvements in production, new orders, employment, and exports as well as a significant decline in input prices due to soft commodity prices. In October, a pronounced rebound in employment helped the services sector to expand at the fastest pace in more than two years, with the ISM Services Index rising to 56, well above consensus expectations of 53.8. The NFIB Small Business Optimism Index markedly strengthened in October amid broad improvements in the underlying components of the index.

Within the S&P 500 Index (+5.9%), all 11 sectors posted positive results for the month. Consumer discretionary (+13.3%) was the best-performing sector, led by automobiles (+34.6%) and broadline retail (+11.5%). Financials (+10.3%) and industrials (+7.5%) also outperformed. Health care (+0.3%) was the worst-performing sector, weighed down by biotechnology (-7.5%). Materials (+1.6%) and communication services (+3.1%) also underperformed.

Europe

European equities (+0.5%) rose in November. The European Commission downgraded its 2025 growth forecast for the eurozone to 1.3%, from the previous forecast of 1.4% in May, due to the structural challenges in the industrial sector, potential trade wars with the US, slowing Chinese demand, and lingering geopolitical risk. The region’s business activity unexpectedly contracted in November as the HCOB Flash Eurozone Composite Purchasing Managers’ Index (PMI) dropped to 48.1. Activity was largely weighed down by Germany and France, where output decreased at a faster pace compared to October. Eurozone employment declined for the fourth straight month, driven by manufacturers, although the labor market remained healthy amid record-low unemployment of 6.3% in October. Against a backdrop of lackluster economic growth, the central banks of Sweden and the UK cut interest rates, while the central bank of Norway left rates unchanged. Annual eurozone headline inflation rose to 2.3% in November but this rise is unlikely to dissuade the European Central Bank (ECB) from lowering rates again in December, as core inflation remained steady at 2.7%. The war between Russia and Ukraine escalated after Ukraine fired missiles into Russian territory. Third-quarter earnings for companies in the STOXX 600 Index are forecast to increase 8.2% from a year earlier, according to LSEG.

Europe’s manufacturing sector deteriorated at a faster pace in November; the HCOB Eurozone Manufacturing PMI fell further into contractionary territory amid a larger decline in new orders, production, purchasing activity, and inventories. Input costs decreased for the third straight month, and output prices continued to fall. The HCOB Flash Eurozone Composite PMI revealed that services sector activity contracted for the first time in 10 months, reinforcing expectations that the ECB will lower interest rates. The European Commission’s Economic Sentiment Indicator remained broadly stable at 95.8 in November; industry confidence improved, while consumer confidence deteriorated.

Germany (+2.5%) will hold a snap election in February after the ruling coalition government collapsed. Chancellor Olaf Scholz dismissed Finance Minister Christian Lindner after they both failed to reach a compromise on economic policy. Against a weak economic backdrop, the ZEW Indicator of Economic Sentiment fell drastically and was below forecasts, with the assessment of the current economic situation continuing to worsen. In the UK (+2.6%), the economy grew just 0.1% in the third quarter as the country’s dominant services sector struggled. The slowdown highlighted the persistent challenges of low productivity and high interest rates. The S&P Global Flash UK PMI Composite Output Index showed that business activity in November shrank for the first time in more than a year amid weaker business optimism and rising cost inflation. In France (-1.6%), Prime Minister Michel Barnier’s government teetered on the edge of collapse over a budget deficit impasse. Barnier’s proposed €60 billion of spending cuts and tax increases lacks parliamentary support, and the Rassemblement National party leader Marine Le Pen threatened to join opposition parties to bring down the government if there were no compromises.

Pacific Basin

Pacific Basin equities (+0.6%) ended the month slightly higher. In Australia (+4.0%), interest rates were unchanged at 4.35%, with the Reserve Bank of Australia (RBA) indicating that inflation remains too high to consider interest-rate cuts in the near term. Annual headline inflation of 2.1% in October was below expectations, but a rise in the trimmed-mean measure to 3.5%, from 3.2%, suggested persistent core inflation. Slower wage growth in the third quarter reflected some easing price pressures, although the labor market remained tight. Wage growth slid below 4% for the first time since mid-2023, rising 3.5% annually during the third quarter, compared with 4.1% in the prior period and below estimates of 3.6%. Australia’s Senate approved an overhaul of the RBA that will split the bank’s board in two, a monetary policy committee and a board that manages the central bank’s operations.

In Japan (-0.8%), central bank Governor Kazuo Ueda said that further interest-rate hikes are “nearing” as inflation and economic indicators released in November trended in line with Bank of Japan (BOJ) forecasts, sending the yen higher ahead of the BOJ’s next meeting, in December. Japan’s tight job market in the third quarter added upward pressure on wages, while inflation in Tokyo was higher than expected in November, with the core CPI (excluding fresh food) climbing 2.2% from a year earlier. Japan’s cabinet was set to approve a new stimulus package worth up to ¥13.9 trillion (US$92 billion) aimed at mitigating the impact of rising prices on households and spurring local government spending. The package comes after Japan’s economy grew at a 0.9% annualized pace in the third quarter, above expectations of 0.7% but well below the 2.2% growth in the second quarter. Encouragingly, consumer spending accelerated 0.9% on the heels of wage increases, defying expectations for a spending slowdown and supporting the BOJ’s view that the economy is sturdy enough to weather higher interest rates. Additionally, exports in October exceeded estimates, climbing 3.1% from a year ago, driven by steady Chinese demand and strong growth in shipments of chip-making equipment.

In Singapore (+9.2%), the Monetary Authority of Singapore raised its GDP growth forecast for 2024 to “around 3.5%,” above its previous estimate of 2% – 3%, as the economy recovers faster than anticipated. However, the government also expressed caution about economic growth in 2025 due to the potential risks of new tariffs from the US. Core inflation in October decelerated sharply to 2.1% — the lowest level since 2021 and below expectations — although strong economic momentum and potential tariffs in 2025 posed upside risks to inflation. New Zealand’s (+4.9%) central bank signaled more policy easing after slashing interest rates by 50 bps in an effort to stimulate the economy, which is struggling to emerge from recession.

Emerging Markets

Emerging markets (EM) equities (-2.7%) fell in November. Latin America led the decline, followed by Asia and Europe, the Middle East, and Africa (EMEA).

In Latin America (-3.6%), Brazil’s (-4.5%) government announced plans to expand income tax exemptions for lower-income Brazilians and increase taxes on higher earners. This came alongside a proposed spending cuts package aimed at achieving 70 billion reais (US$11.6 billion) in savings through 2026 in an attempt to curb the growing budget deficit. However, the spending cuts were far below expectations, sending stocks sharply lower. The central bank raised interest rates by 50 bps, to 11.25%, citing resilient economic activity. Mexico (-1.9%) declined as Donald Trump threatened 25% tariffs on the country. Inflation in the first two weeks of November was below expectations, and the Bank of Mexico lowered its benchmark interest rate by 25 bps to 10.25%, signaling the potential for further cuts. In Peru (-3.1%), anti-government protests erupted in Lima during the Asia-Pacific Economic Cooperation Forum, as President Dina Boluarte’s public approval rating stood at a lowly 4%. Interest rates were reduced to 5.00%, from 5.25%.

In Asia (-3.0%), the possibility of higher US tariffs loomed over the region’s economies. China’s (-4.1%) National Bureau of Statistics reported mixed economic data; retail sales grew at an eight-month-high pace of 4.8% year over year in October, conveying that recent government stimulus has helped to bolster some sectors of the economy. However, the property market continued to struggle as real estate investment between January and October fell by 10.3% from a year ago, worse than the 10.1% drop between January and September. In an effort to stimulate growth, the government approved a 10 trillion yuan (US$1.4 trillion) plan to help local governments refinance their debt and reduce interest costs, although the savings amount to less than 0.1% of China’s expected GDP over the next half-decade. Taiwan’s (-3.2%) government raised its 2024 GDP forecast to 4.3% from 3.9%, aided by the AI boom that has boosted demand for the country’s technology products. South Korea’s (-4.7%) central bank cut its benchmark interest rate by 25 bps to 3.0%, citing slower-than-anticipated economic growth. The outlook for growth in 2024 was lowered to 2.2%, from 2.4%, and dropped to 1.9% in 2025, from 2.1%.

In EMEA (-0.8%), OPEC+ agreed to delay its oil output hike through the end of December. Saudi Arabia (-2.8%) announced plans to cut spending in 2025 due to strains on the budget from falling oil prices. The finance minister said the kingdom will continue strategic spending on projects linked to Vision 2030, the ambitious plan to overhaul the economy and reduce the reliance on oil revenue. South Africa’s (-2.4%) Reserve Bank cut its main interest rate by 25 bps, to 7.75%, as annual inflation slowed to 2.8% in October.

Fixed Income

Market volatility fell following Donald Trump’s win in the US presidential election amid speculation that his economic policies would boost growth and corporate earnings. Most fixed income sectors outperformed government bonds on an excess-return basis.

US economic releases were largely encouraging. Consumer data was positive, driven by increased confidence in business conditions and employment prospects. Personal income and spending grew as a solid labor market continued to support consumers, while retail sales benefited from higher spending on cars and electronics. Most employment data held steady, although job growth fell in October amid the impacts of strikes and hurricanes. Annual inflation ticked higher, with the core PCE Price Index and producer prices excluding food and energy slightly exceeding previous levels. The manufacturing PMI remained below the expansionary threshold according to S&P Global, while the services PMI posted solid growth. In the housing market, pending home sales beat expectations, led by the Northeast and West regions. In Europe, the HCOB Eurozone Manufacturing PMI slid further into contractionary territory, and industrial production faltered. Germany’s ifo Business Climate Index weakened as the assessment of current conditions and expectations fell. The UK’s annual headline inflation reached its highest level since April, while industrial production declined. China’s annual industrial profits fell amid weak demand and a struggling property sector, and headline inflation was weighed down by weakness in private spending. Japan’s Producer Price Index accelerated higher, led by higher costs for nonferrous metals, food, and oil. Canada’s housing starts and building permits advanced. Australia’s annual inflation was slightly lower than expected.

The US Fed lowered interest rates by 25 bps, and anticipates further rate cuts, albeit at a slower pace. The Bank of England (BOE) cut rates as economic data disappointed and growth expectations eased following Chancellor Rachel Reeves’ Budget announcements. In EM, the central banks of South Africa and Mexico lowered their rates as growth moderated. Most other major central banks left policy rates unchanged.

Most global sovereign yields ended lower. US Treasury yields sold off sharply earlier in the month following Trump’s election victory, but the move reversed as the Fed delivered its second straight rate cut and traders started to unwind some of the trades that were made in anticipation of Trump’s election victory. Trump’s nomination of Scott Bessent as the new Treasury Secretary was well received by markets given Bessent’s fiscally conservative stance, adding to the downward pressure on bond yields later in the month. In Europe, German bund yields fell due to the negative economic implications of Trump’s anticipated tariff policies and mounting political uncertainties, particularly in Germany and France. The BOE’s rate cut amid weaker-than-expected economic data and tempered growth expectations drove UK gilt yields lower. Japanese government yields bucked the trend and rose as core inflation spiked. EM sovereign yields moved notably lower, led by South Africa following a rate cut by the country’s central bank. The Bloomberg TIPS index delivered a total return of 0.48%, and the 10-year breakeven inflation rate decreased by 6 bps, to 2.27%, during the month.

Global credit outperformed duration-equivalent government bonds as spreads tightened. Within the securitized sectors, agency mortgage-backed, commercial mortgage-backed, and asset-backed securities outperformed duration-equivalent government bonds. Within EM, local markets debt (-0.57%) underperformed external debt (+1.19%), in US-dollar terms. Spread narrowing contributed favorably to external debt performance, and a decrease in US Treasury yields also had a positive impact. Depreciation in EM currencies drove negative performance within local markets, while EM rates benefited results.

Currencies

The US dollar appreciated against most developed market and EM currencies, fueled by Trump’s victory and a Republican sweep of both chambers of Congress, which spurred beliefs that the new administration’s policies would significantly boost the US dollar. Among the G10, the euro was weighed down by the eurozone’s heavy reliance on exports, significant exposure to China, and lackluster economic growth. The Japanese yen gained against the US dollar, driven by renewed speculation for a December rate hike by the BOJ. In EM, performance was broadly negative, driven by Trump’s threats to impose stiff tariffs on imports from China and Mexico. Latin American currencies led the underperformance. The Brazilian real plunged to an all-time low after a lower-than-expected proposed cut to public spending. The South African rand slumped amid softer gold prices, a stagnating Chinse economy, and uncertainty about future US policy.

Commodities

Commodities (+0.1%) ended slightly higher in November. Agriculture & livestock advanced, energy was flat, and precious metals and industrial metals detracted during the period.

With energy (+0.0%), natural gas (+15.2%) rallied after the US Energy Information Administration highlighted a tighter global market heading into winter. Limited growth in liquefied natural gas (LNG) supply, changes in pipeline flows due to the expiring Russia/Ukraine transit contract, and operational issues at LNG export facilities constrained supplies. At the same time, colder weather forecasts and problems with electricity power generation have bolstered the demand for LNG as a fuel source. Expectations for import tariffs by the US, a significant buildup of stockpiles in the US, and slower-than-expected interest-rate cuts created uncertainty in the oil market. Against this backdrop, gas oil (+1.2%) rose, while crude oil (-0.9%), heating oil (-2.0%), and gasoline (-2.3%) declined.

Industrial metals (-2.2%) fell during the period. Lead (+3.2%) rose due to an expected reduction in output, as several smelting enterprises in China will undergo maintenance in December. Zinc (+2.7%) increased after the Trafigura Group, one of the world’s largest zinc traders and producers, placed a huge order in London Metal Exchange warehouses during the period. Nickel (+1.2%) ended higher as the Indonesian government increased nickel imports to meet rising local demand, and local mines faced production disruptions due to weather-related issues. However, Trump’s threat of higher tariffs on China, coupled with a stronger dollar and concerns about slowing economic growth in China, pressured aluminum (-0.6%) and copper (-5.3%) prices.

Precious metals (-3.3%) slid during the month. Silver (-6.1%) and gold (-3.0%) dropped following Trump’s election victory, as markets feared that his potential tariffs and immigration policies could reignite inflation. Higher inflation expectations and a stronger dollar make non-yielding assets such as gold and silver less attractive to investors.

Agriculture & livestock (+2.2%) ended the period higher. Cocoa (+31.9%) soared due to supply concerns caused by adverse weather in the Côte d’Ivoire and Ghana that disrupted harvesting. Coffee (+30.0%) rallied after a severe drought in Brazil earlier this year greatly reduced output. Additionally, recent heavy rains in Vietnam worsened harvesting conditions, further constraining the global coffee supply. Feeder cattle (+7.9%) rose following news that Mexican cattle imports might be restricted after a cow in Chiapas was infested with the New World screwworm. Lean hogs (-1.6%) were pressured by lower wholesale prices and lower pork cutout values, as reported by the US Department of Agriculture. Wheat (-6.4%) fell due to an improved supply outlook and a stronger US dollar, which could negatively impact exports. Sugar (-7.0%) declined, driven by a record low in the Brazilian real and an increase in sugar supplies.