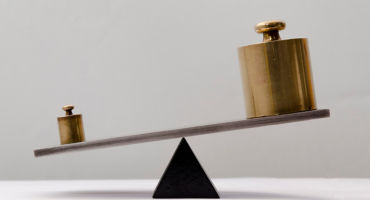

Our positive outlook for value

We see some of the key drivers of value premia that we identified earlier lining up in favor of value over the next three to five years.

Inflation

Even if central banks have managed to rein in inflation for the near term, we expect several structural factors to play a role in keeping inflation elevated relative to recent history — a theme emphasized by our Global Macro team. Tight labor markets are likely to persist, driven by shrinking working-age populations and uncertainty about immigration, among other factors. Amid rising geopolitical tensions, deglobalization and supply chain disruptions (e.g., encouraging businesses to shift from offshoring to “friendshoring” with allies) will add to inflationary pressures. Finally, the spending required by the green energy transition could create supply/demand imbalances across a swath of commodities, such as copper, nickel, and cobalt, driving prices higher (particularly given recent underinvestment in commodity production).

Real rates

In an environment of higher inflation, it is reasonable to assume that real rates will also need to be higher as a result of tighter monetary policy. Higher interest rates have a direct impact on financials (which, as shown in Figure 3, remain a large weight within the value index), and especially banks, which experience a boost to net interest margins. In 2023, higher rates wrought havoc with the capital levels of some regional banks due to losses on their long-duration securities portfolios compared to their short-duration liabilities, and those smaller banks may be under pressure in the near term. But financials offer a wide playing field beyond banks, including insurance companies, asset managers, and payment services, where we think there may be attractive value opportunities. Higher real rates may be supported by improving economic growth as well — a combination that is typically beneficial for value (we may already be seeing signs of this in improving equity market breadth as discussed below).

Risks to our view

The main risk we see to our positive outlook for value is generative AI. If the optimism about AI is matched by the reality of an enormous addressable market that could drive exponential earnings growth over coming years, regardless of the economic cycle, then growth stocks could continue to enjoy a multiyear period of outperformance.

That said, we are seeing signs that markets are differentiating between the megacap tech stocks more and that as recession fears have receded, the equity rally is broadening to include value-oriented sectors, small caps, and equity markets outside the US. Longer term, we also see potential headwinds for megacap tech stocks. Policymakers are being called on to create standards and regulations to ensure the safe use of these powerful new tools, potentially reducing AI’s impact on growth and productivity. In a similar vein, regulatory scrutiny could limit the growth of companies in this space, at least via acquisitions. We also think the amount of capital spending required to meet large TAM (total addressable market) estimates may exceed revenue growth expectations given that we remain in the early stages of AI adoption by industries outside of technology.

Conclusion

Our research suggests that the performance of value stocks is not necessarily aligned with the economic cycle. In different periods, inflation, real rates, and GDP can contribute to the value/growth cycle. In addition, the sector composition of the value stock universe is more diversified than in the past, with technology, health care, and other traditionally growth-oriented sectors now better represented. Over the next few years, we believe structurally higher inflation and real rates will both be supportive of value. At the same time, since there are pitfalls in relying on any historic model to predict the next cycle, we think asset owners should seek more balance in their portfolios after growth’s long rally.

Equity Market Outlook

Continue readingBy

Andrew Heiskell

Nicolas Wylenzek