Asset allocation implications

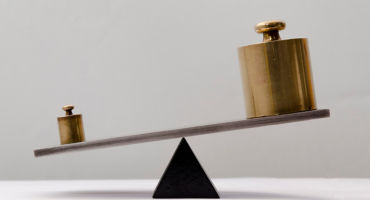

From an asset allocation perspective, higher volatility and dispersion between regions has multiple implications, and counterintuitively, these are not all negative. Volatility creates higher risk but also opportunity, hence asset allocators need to think carefully about how they adapt their portfolio approach.

On the positive side of the balance sheet, a divergent regime provides:

- A wider opportunity set — across phases of the cycle as economies increasingly move through their cycles at different paces, with countries having more control over the impact of their fiscal and monetary policies. From a systemic perspective, this reduces the probability that the global economy is one “US accident” away from a global recession or crisis.

- Greater potential for portfolio resilience — Even if volatility is higher, more dispersion between regions and a growing reliance on domestic drivers may increase the potential for asset allocators to enhance portfolio resilience and reduce overall risk given the likely beneficial impact of decorrelation.

On the negative side, reduced correlations come at a price:

- Higher volatility —More pronounced and diverging cycles will lead to greater volatility and more unpredictability in asset prices.

- Lower productivity — Deglobalisation will erode productivity gains resulting from lower trade barriers and global supply chain efficiencies and may translate into lower economic growth, higher inflation and, ultimately, lower asset returns.

- Debt sustainability — The massive transfers made by governments to support their citizens in recent years are raising questions about debt sustainability, particularly as the path to fiscal consolidation is harder to envisage given the current tendency towards polarised and populist politics. In combination with reduced global trade flows, these higher fiscal deficits may contribute to higher and stickier inflation but also to a rise in term premia — as investors require higher compensation for the risk taken, which, in turn, could put pressure on the valuations of a wide range of assets in both public and private markets.

To prosper in this new regime, we think investors need be highly deliberate and systematic in their portfolio construction, with the above risks and opportunities in mind. This includes thinking about:

- Factor and beta exposures in a systematic way;

- Optimum use of active research-led approaches at both a security and thematic level;

- Increased geographic diversification across developed and emerging markets while keeping a very close eye on emerging country-specific risks;

- Currency hedging as higher currency volatility may strengthen the case for currency risk hedging in portfolios; and

- Higher allocations to alternatives to provide further diversification and help shield portfolios from volatility by providing potentially uncorrelated returns.

In summary

Based on our research, we believe we are returning to a world of macroeconomic divergence. Investors should prepare for that eventuality and use the above considerations to help adjust their asset allocation.

Equity Market Outlook

Continue readingBy

Andrew Heiskell

Nicolas Wylenzek