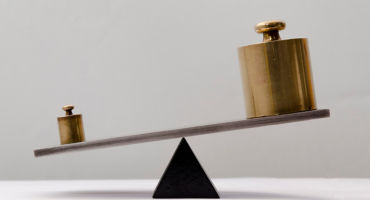

Is progress sustainable?

While, of course, wealth inequality undoubtedly exists and an ultra-wealthy few have a far more advantageous economic stronghold than the lowest quintile of earners, perhaps some progress has been made. The question now: Is this progress sustainable?

There are several things to consider in trying to answer this question. Real estate will obviously be a determining factor. Some analysts predict a major pullback in home prices, if not a collapse. However, we maintain the conviction that home prices could surprise to the upside given a significant supply/demand imbalance and argue that the US may be short more than a million single-family homes. It’s worth noting, however, that price appreciation has slowed under the weight of higher interest rates and home prices have been flat since June 2022. We expect this resilience to continue, with only a slight decline in home prices through the end of 2023.

Meanwhile, we expect wage inflation to continue bolstering low-end consumer spending power. In recent years, the rate of wage growth among workers with a high school degree versus a four-year college degree have come into parallel. Previously, wage growth tended to be higher among college-educated employees.1 There’s good reason to believe that this trend will continue.

Additionally, labor shortages persist across many industries. As of the end of 2022, the leisure and hospitality industries were still down more than 50,000 workers compared to February 2020.2 In durable goods manufacturing, wholesale and retail trade, education, and health services, there are more unfilled job openings than unemployed workers with experience in their respective industry. In fact, even if every single unemployed person with experience in the durable goods manufacturing industry were employed, 25% of the available jobs in this industry would remain unfilled.3

The resurgence of organized labor could buoy middle and low-end worker wages. In fact, de-unionization has accounted for roughly a third of the growth in the wage gap between high- and middle-income workers since 1979.4 As labor has gained negotiating power in recent years, we see a corresponding uptick in union membership and “major work stoppages.” This momentum appears to be increasing in 2023, headlined by the writers’ and actors’ strike in the entertainment industry and by the massive United Auto Workers strike — both explicitly undergirded by inequality-driven grievances that top executives (and the biggest celebrities, in the case of the entertainment industry) are taking home too big a piece of the total pie. Today, 71% of Americans approve of unions — the highest approval rating since 1965.5

Equity Market Outlook

Continue readingBy

Andrew Heiskell

Nicolas Wylenzek