Five ways to target quality growth

Long-term growth is about more than growth

If targeting high growth is about seeking out the companies that have the highest scope for earnings and revenue expansion, we believe seeking out companies that offer a compelling combination of growth and other characteristics can lead to a portfolio that sits between core and aggressive growth on the spectrum, which may result in a superior risk/reward over time. While we believe revenue growth is a good predictor of long-term excess return, based on our research, we think that cash-flow margin and return on capital (quality), cash-flow yield (upside potential) and the combination of share buybacks and dividend yield (capital return to shareholders) can also be powerful predictors of outperformance. We therefore focus on these in our process (Figure 2). We find that stocks with these characteristics are less dependent on one investment style, such as growth, in order to do well, meaning that they have the potential to perform well in a variety of different environments, not just ones in which high-growth stocks flourish. Conversely, this can also help protect relative performance when equity markets decline.

Seek a more balanced approach to risk and reward

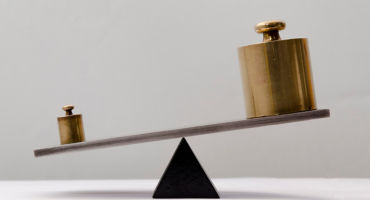

An investor in high-growth equities doesn’t necessarily expect that all the companies will achieve high returns. More commonly, some companies may do extremely well while other companies may do very poorly. The hope is that the most successful companies do so well that this counteracts the poorer performers. With this approach, the potential for reward may be great, but the potential for risk is also significant. Maths tells us that underperforming by 25% in down markets requires outperforming by 33% in up markets just to get back to neutral.

By contrast, we believe that targeting companies that offer growth as well as quality, capital returns and upside potential is likely to result in smoother performance by not having a narrow focus on growth at any cost. While there may be relative winners and losers in the short, medium and long term, the expectation is that this discipline around stock selection provides an element of downside protection that may be missing in more aggressive growth allocations.

Pay attention to market signals

Equity markets are influenced by changes in the economic cycle. We believe that dynamic positioning informed by data supports an active investor’s ability to protect capital when the global economic cycle decelerates and to keep up when the global economic cycle accelerates. For example, we rely on a proprietary global cycle index to track when global economic activity is getting better or conversely getting worse. This dual focus on both top-down macroeconomic factors and bottom-up analysis enables us to tilt exposures based on where we are in the economic cycle.

Consider the stock life cycle

Companies display different characteristics depending on where they are within their life cycle. Regardless of how a company might score on each of our four key attributes, a change in fundamentals can serve as an impetus to reassess its potential in the short and long term. This information can help inform elimination or buyback decisions.

Think beyond the Magnificent 7

The Magnificent 7 have been prominent drivers of equity market returns, but a narrow focus can lead investors to overlook sources of growth elsewhere. We believe a disciplined process can help identify ideas both within and outside of this group, and that it is possible to find alpha outside of the “Mag 7”, in sectors as diverse as industrials, communication services and financials.

Equity Market Outlook

Continue readingBy

Andrew Heiskell

Nicolas Wylenzek