Low-carbon transition categories

Energy generation & storage

Meeting the dual imperative of generating reliable, inexpensive energy while achieving decarbonization goals for the power sector will not be easy. New demand sources, including the increased adoption of battery electric vehicles (BEVs), deployment of data centers to support AI computation, and anticipated widespread switching to heat pumps, among other trends, will continue to drive energy consumption. Urbanization and the growing potential for more heating-degree days (when more energy is needed for cooling) will increase global power demand as well. Alongside the need to generate more power is the need to store it. The inherent intermittency of renewable energy sources like wind and solar will require utilities to manufacture their base load and manage reserves with a combination of large-scale battery storage and power-demand management.

Transportation

Another daunting transition challenge is the decarbonization of transport, one of the largest sectoral contributors to carbon emissions. The reduction of transportation-related emissions will likely result in the accelerated adoption of electric and hybrid light-duty vehicles in the near to medium term. Internal combustion engines (ICEs) and related biofuels should continue to play an important role in medium- and heavy-duty transport, especially in developing markets like Brazil and India, especially if metals and power bottlenecks slow the automotive industry’s ability to manufacture and sell EVs in these classes.

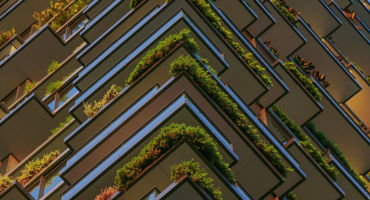

Construction and manufacturing

From building materials and building systems to clothing and consumer-goods packaging, the world is increasingly finding ways of lowering the carbon footprint of our physical surroundings while increasing circularity and recycling. Commodities with low relative carbon or water intensity and those that can enable the use of recycled materials will likely see rising demand and falling production costs. We expect the ongoing trend of de-commoditization to lead to the development of new investable commodity contracts with lower carbon intensity.

Agriculture

The world is grappling with the offsetting challenges of a growing population and increasing physical risks of climate change that threaten major food crops, including wheat, corn, and soybeans. Reducing emissions from farming and ranching while developing climate-resilient crops and plant-based proteins is a focus for policymakers around the world. Like energy production, sustainable food production is also seen as key for economic and geopolitical stability.

Sustainable commodities: A to Z

Aluminum is deployed in low-carbon transition technologies as a cathode in lithium-nickel-cobalt-aluminum oxide batteries and hydrogen fuel cells. Aluminum requires more investment to reduce production-related carbon emissions, decrease energy use, and increase recycling rates, especially in developing economies. Using recycled aluminum reduces its carbon footprint by up to 20 times.1

Biodiesel is a critical low-carbon fuel which uses a variety of feedstocks that are recyclable and, in some cases, the production of which (such as soybeans) can reduce sequester emissions. Apart from improving air quality, biodiesel improves engine efficiency and increases safety due to lower combustibility relative to standard diesel.

Copper is central to the world's ability to expand the electric grid and accommodate the development of renewable power and EVs. There are no known substitutes for these technologies and reuse of copper material is limited. For these reasons, access to copper will likely dictate the pace of the energy transition over time. Time matters a great deal with copper, as bringing new copper production online can require a decade or more. For a host of reasons, ranging from economic to political, there is a dearth of copper mines around the world today, a lack of investment to develop new mines, and scant technological breakthroughs to boost mining productivity.

Corn, an abundant crop, is widely used in food products for humans and animals. It is also a critical feedstock for biofuel production via secondary products such as ethanol and corn oil. Physical climate risks, including heat, drought, and extreme precipitation will continue to pressure corn yield growth in the medium term as temperatures rise and land becomes drier. Higher prices allow for innovation by farmers to use less land and fewer resources in an effort to produce corn more sustainably.

Environmental credit markets, including RECs, LCFS, and carbon allowances, are a growing market. California and the European Union use carbon allowances as a policy mechanism to internalize the exogenous cost of carbon and reduce GHG emissions. These cap-and-trade systems incentivize carbon emitters and consumers to consider — and reduce — the cost of carbon in their activities.

Lithium, Earth’s lightest metal, is critical for battery technology, including for laptop computers, cell phones, and EVs. As more than half of the world’s lithium ore is processed in China, other nations, most notably the US, are keen to develop alternative, sodium ion-based battery technologies. These solutions are far off, however, so in the near to medium term, lithium will likely remain the key battery component. Global EV demand has slowed recently for a number of reasons, including the continued popularity of hybrid vehicles that require less lithium than full BEVs. With prices potentially at a trough, we could see a bifurcation in the lithium market, with China fully dominating until EV demand rebounds.

Natural gas plays a key role in providing inexpensive and consistent power, the production of which is becoming incrementally less carbon intensive as methane capture practices expand. With the adoption of BEVs potentially increasing US household power demand by 40%, reliable, inexpensive energy will be crucial for the energy transition. Research by the Center for Climate and Energy Solutions highlights that natural gas emits about half as much CO2 as coal and 30% less than oil, as well as far fewer pollutants per unit of energy delivered.2 Natural gas has also contributed to a shift away from coal in power generation.

Nickel is used in geothermal technologies, BEVs, energy storage, carbon sequestration, and solar power concentration. It is also highly recyclable, helping meet consumer demand via the secondary market.

Precious metals (gold, silver, platinum) are poised to play increasingly significant roles in decarbonization efforts. Platinum enables the reduction of carbon and methane emissions from ICEs, while silver is used in the manufacturing of solar panels. Platinum is also a catalyst for proton exchange membrane hydrogen fuel cells, providing the durability, stability, and reactivity necessary to strip the hydrogen of electrons to produce electricity. In the near term, gold, silver, and platinum may continue to benefit from Chinese and Indian imports, central bank purchases amid de-dollarization efforts, and increased investor appetite as interest rates decline.

Scrap steel and iron ore account for approximately 7% of total greenhouse gas emissions and 11% of CO2 emissions globally.3 Finding solutions to reduce emissions while enabling the construction of wind and solar farms is critical for the energy transition. The EuRIC reports that with recycled steel alone, there is an 86% reduction in air pollution, 76% reduction in water pollution, and 40% less water used in the steel-making process.4 Higher scrap steel prices encourage the collection and processing of scrap as well as the transition of blast furnaces to electric arc furnaces by steel producers.

Soybeans, an essential food and livestock-feed crop, are also used to produce soybean oil, a key biofuel ingredient that enables clean forms of transportation, especially in heavier-duty vehicles in the industrial, aviation, and maritime industries. Rising temperatures, drought susceptibility, and shrinking arable land areas threaten the durability of soybean production in major regional markets. The silver lining is that rising soybean prices have enabled farmers to innovate with technology that allows them to use less land and fewer resources to produce soybeans more sustainably.

Uranium is a no-carbon energy source used in nuclear power generation. It has no negative impact on air quality, requires less land mass and generates far less waste, relative to alternatives. The use of uranium allows consumers to become less reliant on fossil-fuel energy production, particularly in geopolitically unstable regions. Uranium supply remains tight following prolonged underinvestment and is subject to bifurcated cost curves given changing geopolitical dynamics that can affect material-sourcing requirements.

Wheat is essential for food access in regions around the world. Geopolitical disruptions, including a prolonged war in Ukraine, a major producer, may endanger global wheat supplies and necessitate production increases in more stable regions. Wheat is produced with a lower carbon footprint than other crops.

Zinc is primarily used as a galvanizing alloy to prevent corrosion. It serves an important function in the deployment of renewable-power infrastructure, especially in offshore wind, where anti-corrosion is essential. Research is underway to deploy zinc in photovoltaic cells as a potential substitute for silver.

Conclusion

While regional policies and institutional investor demands initiated the energy transition, economic factors, energy security concerns, and geopolitical tensions have accelerated this dynamic. Ultimately, we believe these three drivers will also maintain the momentum for global decarbonization, setting a firm, long-term foundation for commodity demand. Evolving consumer sensitivity to the environmental and geopolitical impact of supplies will require greater specification and differentiation in investable commodities.