So why has India outperformed China?

As we commented recently: “In China, everything is because of the government; in India, everything is despite the government.”

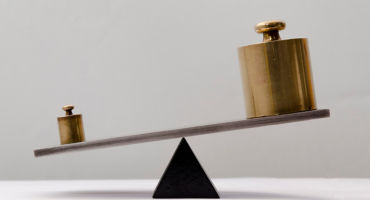

While China has provided ample support to industry development over the decades, including putting in place world-class infrastructure for transport and distribution and offering material subsidies, this has not been the case in India. In effect, the cost of capital has been far higher in India than in China, while competition among industry players has been lower. In turn, we believe this has led to a ”survival of the fittest” outcome across the Indian equity market, with many companies that generate sustainably higher returns on capital emerging as “winners.” These high levels of return on capital have, to a large degree, driven the strong performance of the Indian market over time.

Can India continue to outperform?

Of course, past results are no guarantee of future results. Having performed so strongly in recent years, it’s possible that India’s equity market may take a breather for a period. That being said, India is an often-overlooked performance story that we believe may still have further to go. Looking across the market today, we continue to see a range of bottom-up investment opportunities in companies that we think have the ability to compound capital for years to come.

Equity Market Outlook

Continue readingBy

Andrew Heiskell

Nicolas Wylenzek