- Investment Director

Skip to main content

- Funds

- Insights

- Capabilities

- About Us

- My Account

The views expressed are those of the authors at the time of writing. Other teams may hold different views and make different investment decisions. The value of your investment may become worth more or less than at the time of original investment. While any third-party data used is considered reliable, its accuracy is not guaranteed. For professional, institutional, or accredited investors only.

After a lengthy break, global inflation is back, as evidenced by persistently high prints across both the developed and emerging worlds through the first seven months of 2022. As our colleagues Eoin O’Callaghan and Marco Giordano recently discussed, the euro area’s seeming inability to “inflate” has long been a foregone conclusion for many market participants. However, the current macroeconomic environment presents a new and somewhat daunting challenge for European fixed income investors: how should I approach asset allocation following an extended era of near-deflation and central bank-induced volatility suppression?

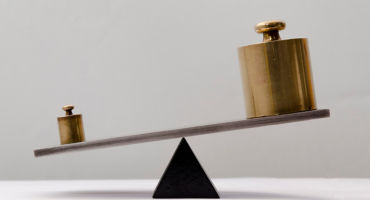

While passive investment strategies can continue to offer investors exposure to broad market beta, we believe that today’s new regime of rising inflation, higher interest rates and increased dispersion across fixed income sectors and regions is fertile ground for skilled active management. With that in mind, now may be a good time for investors to position their portfolios opportunistically.

While the recent return of inflation is largely a global phenomenon, inflation in Europe is being driven by some different catalysts than US inflation, with each region also facing its own distinct structural headwinds. This divergence between the two creates potential opportunities for investors.

Within Europe, higher inflation is primarily a function of elevated energy and food prices. Businesses and consumers alike have been bearing the brunt of rising costs in these staple areas. To make matters worse, European markets have been grappling with the very real possibility of a complete loss of Russian gas supply. Across the region, individual country strength is beginning to diverge: not surprisingly, countries that are most dependent on Russian gas imports look more likely to falter going forward. The European Central Bank (ECB) will have to carefully balance multiple policy considerations in order to avoid another euro-area crisis.

Within the US, however, recent inflationary pressures have been more demand-driven than in Europe. Record-low levels of unemployment, a sizeable (and growing) energy sector and relatively solid corporate and consumer balance sheets have expanded the toolkit available to the US Federal Reserve (Fed) in its fight against inflation, allowing the Fed to take on increased domestic recession risks as it also attempts to cool the nation’s surging prices. In short, we believe the demand-fuelled resilience of the world’s largest economy favours the likelihood of a shallower, briefer recession in the US than many other observers fear.

The differing recession threats and inflation sources in the euro area versus the US have been priced in by their respective fixed income markets. As shown in Figure 1, since Russia’s invasion of Ukraine earlier this year, euro-area credit spreads have widened relative to their US counterparts, reflecting Europe’s greater vulnerability to economic fallout from the ongoing conflict.

The Russia/Ukraine war, stuttering global supply chains and fragmented politics worldwide have only added further conviction to our long-term theme of deglobalization, as explored in our mid-year outlook.

In addition, many central banks are being forced to redefine their policy “reaction functions” in response to new, idiosyncratic economic and market challenges. In our view, gone now are the days of central banks seeking to smooth or suppress market volatility through excessive asset purchase programs. Instead, we expect major global central banks to become providers of such volatility and, for the first time in history, material net sellers of assets. A shift in global monetary policy of that order brings a heightened risk of policy mistakes by one or more central banks — for example, hiking interest rates too early, too late, too much or too little.

Although the outcome of all this remains uncertain, including by geographic region, we expect continued market volatility across fixed income sectors in the period ahead. We believe that active fixed income investment managers who are able to combine bottom-up fundamental and macroeconomic research with tactical positioning based on their views of the credit cycle will be best placed to capitalize on this dynamic environment.

In our judgement, having an opportunistic element to asset allocation implementation will be key to exploiting the regional imbalances that are likely to arise later this year and beyond. By selecting global investment strategies with flexible regional allocations, investors can rely on the skill and depth of active portfolio managers to identify such opportunities early on and to adjust their geographic weightings as new information comes to light. Alternatively, investors can take greater control of their regional allocations themselves, fine-tuning their portfolios based on their own market outlooks.

Either way, with those regional imbalances likely to occur with increased frequency and severity, adding more flexibility to a global portfolio may allow investors to benefit from attractive relative-value opportunities, while managing overall risk in an explicit manner. We think now is the time to re-evaluate your fixed income allocations accordingly.

Going their separate ways: Capitalizing on bond divergence

Continue readingSecuritized credit: Opportunity amid tight corporate spreads?

Continue readingURL References

Related Insights

Stay up to date with the latest market insights and our point of view.

Accelerating the future of active management

CEO Jean Hynes explains how Wellington is building for the future of active management by investing in our capabilities and aligning our organization and talent with clients’ shifting needs.

Concentrated markets: Implications for active management, manager research, and multi-manager capital allocation

Members of our Fundamental Factor Team share research insights on the portfolio impact of benchmark concentration and highlight tools that may help, including extension strategies, passive-share analysis, and index-completion approaches.

Going their separate ways: Capitalizing on bond divergence

Our fixed income experts discuss how to position portfolios for a world of uncertainty and divergence, exploring key themes and evolving bond opportunities for 2025.

Scaling opportunities in a new economic era

Explore our latest views on risks and opportunities across the global capital markets.

Securitized credit: Opportunity amid tight corporate spreads?

Portfolio Managers Rob Burn and Cory Perry discuss why they believe securitized credit has an attractive role to play in today’s tight-spread environment and highlight potential areas of opportunity in 2025.

Time to get active? 5 equity investment ideas for 2025

As we head into 2025, growth seems poised to accelerate, especially in the US. Equity Strategist Andrew Heiskell and Macro Strategist Nicolas Wylenzek see five themes that may create opportunity across global equity markets.

Equity Market Outlook

In our Equity Market Outlook, we offer a range of fundamental, factor, and sector insights.

The credit cycle has been extended — but what’s next?

Credit experts Derek Hynes, Joe Ramos and Will Prentis discuss why they believe the current credit cycle still has legs and explore likely implications for credit portfolios in 2025.

High-yield credit investing: it’s a marathon, not a sprint

Fixed Income Portfolio Manager Konstantin Leidman explains his focus on the high-quality companies likely to outperform over the long term and why he is wary of the hype surrounding potentially bubble-inducing developments like generative AI.

Time for bond investors to take the wheel?

Volatility makes bond investing less straightforward, but it can also create opportunities, provided investors are in a position to "take the wheel" in order to capitalise on them.

The power of local perspective: the long and short of European equity investing

Dirk Enderlein and Boris Kergall explain why, in their view, the structural changes impacting European equity markets offer active long/short investors a rich source of potential return and diversification.

URL References

Related Insights

Equity Market Outlook

Continue readingBy

Andrew Heiskell

Nicolas Wylenzek